You should not take tax advice from YouTube content creator RockstarFlipper.

Casey Parris, also known as RockstarFlipper, published a YouTube video on January 1, 2024 entitled How much Taxes do Ebay sellers have to pay in 2024? The aim of the video was to explain to his fellow eBay resellers on how much money they will need to pay in taxes for 2023. Almost everything presented in the video was factually wrong.

For example, he said that if you take the standard deduction, you are not allowed to deduct expenses. This is not true.

From CNET:

Self-employed and business owners can deduct work expenses even if they take the standard deduction

If you’re self-employed or own a business, you can deduct business expenses on your taxes regardless of whether you take the standard deduction or itemize.

Business expenses are known as above the line deductions which are available regardless of the choice to itemize.

By not deducting expenses from the revenue you earn selling used junk on eBay, you would pay tax on the gross, not on the net. For example, if you do not deduct expenses, you would pay income tax on the money collected from the buyer to ship the item they purchased.

That’s not the way taxes work

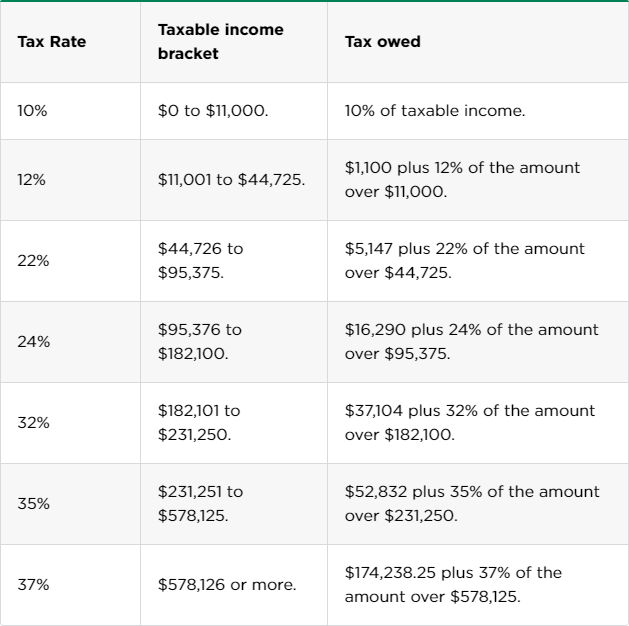

It’s clear from the video RockstarFlipper does not understand how tax brackets work. He doesn’t seem to realize tax brackets are cumulative. Case in point, he said in the video that if you earned over $578,126 during the year 2023, you paid a tax of 37% on everything you earned. That’s not how it works. Everyone pays the same tax rates. If you made over $578,126 last year, you are taxed 10% on the first $11,000. You are then taxed 12% on anything earned above $11,000 and up to $44,726. Your tax rates take a similar path until you arrive at the last tax bracket of 37%. You only pay a tax of 37% on income above $578,126.

For example, let’s say you earned $578,226 in 2023. You would only pay a 37% tax rate on the $100 you made that exceeded $578,126.

Another glaring problem with the video is RockstarFlipper didn’t say a word about eBay resellers needing to pay self-employment tax.

In conclusion

If taxes sound complicated, that’s because they are. Our tax system is designed to be complicated. It’s why most people pay someone to do their taxes or use expensive software to do their taxes. I fall into the latter group. I pay for TurboTax. Last year I paid a total of $227.68 to get access to all the modules we needed to calculate our taxes.

I think it’s safe to say RockstarFlipper shouldn’t be making videos about taxes. He should be watching videos about taxes.

The video: